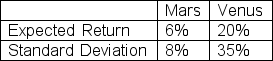

Suppose you observed the following data on two securities: Mars and Venus:

You short sold 200 shares of Mars at $20 per share and purchased 400 shares of Venus at $25 per share to increase the possible return on the portfolio.The correlation between the securities is 0.30.What is the standard deviation of the portfolio?

A) 7.06%

B) 26.56%

C) 32.45%

D) 56.96%

Correct Answer:

Verified

Q67: The standard deviation and expected returns for

Q68: The expected returns for Bumpy Inc.and Bouncy

Q69: A portfolio is composed of 100 shares

Q71: The expected returns for Hickory Inc.and Dickory

Q73: Indiana Jones intends to form a portfolio

Q74: The expected return on Alpha Inc.is 8

Q75: Your portfolio that has $500 invested in

Q76: Suppose you plan to create a portfolio

Q77: Cinderella plans to form a portfolio with

Q97: Which portfolio represents the minimum variance portfolio?

A)B

B)C

C)A

D)D

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents