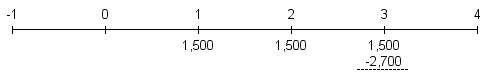

Felix has been offered a three-year ordinary annuity with annual payments of $1,500.The price of the annuity is $2,700.Which of the following is the most appropriate timeline for this investment?

A)

B)

C)

D)

Correct Answer:

Verified

Q2: Ingrid has invested $10,000 in a Guaranteed

Q22: Consols are British bonds that were issued

Q23: An investment pays $1,000 per year for

Q24: An investment pays $2,000 every second year

Q25: Elvira is considering buying a 20-year annuity

Q29: Montreal Financial Services Company offers a perpetuity

Q30: Your mother has just retired.The balance in

Q31: Xiang invests $25,000 per year,starting today,for 20

Q34: Montreal Financial Services Company offers a perpetuity

Q38: Montreal Financial Services Company offers a 50-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents