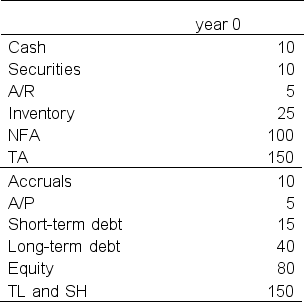

Company A's current sales are $120.The balance sheet is below.Suppose the sales growth rate is 10%.Short-term debt,long-term debt,and equity do not change.What is the external financing needed for next year?

A) $13.5

B) -$13.5

C) $165

D) $151.5

Correct Answer:

Verified

Q67: When using a percent of sales method

Q69: What is the difference between invested capital

Q73: Which of the following is TRUE?

A)Interest expenses

Q74: Which of the following is not a

Q75: Which of the following is TRUE?

A)Interest expenses

Q80: If a company has good growth potential,

Q81: Discuss some difficulties when comparing the ratios

Q82: List the different steps in the percentage

Q84: A firm has $1,750,000 of total assets

Q88: Mr.B.Baggins has just computed the operating margin

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents