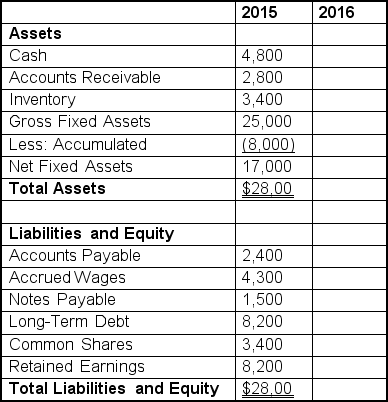

In 2015,Inglis Arctic Sports (IAS)had total sales of $35 million.The firm earned $3.00 per share and paid dividends of $1.00 per share.There are 1 million shares currently outstanding.The 2015 year-end balance sheet is shown below:

Inglis Arctic Sports

Consolidated Balance Sheet

(at year end in thousands of dollars)

You are a financial analyst with IAS and have been asked to prepare a financial plan for next year.You have been given the following information and projections for 2016 from the marketing and production departments:

•Sales are projected to grow by 15 percent in 2016.

•New capital expenditures will be $3.75 million for the replacement of a production line.

•Depreciation expense of $1,200,000 will be recorded in 2016.

•The new more efficient production line is expected to result in an inventory increase of only 7.5 percent from 2015 levels.

•Management would like to achieve a total debt-to-equity ratio of 1.0 in 2016,while keeping long-term debt unchanged from 2015.

•Management expects the net profit margin and dividend payout ratios to remain the same as in 2015.

Forecast the 2016 balance sheet for IAS.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: What are the three ratios used in

Q83: Zhang has observed that the sales of

Q84: A firm has $1,750,000 of total assets

Q84: What is the major implication of the

Q85: Which of the following is false?

A) Financial

Q87: EXLO Company has current sales of $100,000

Q88: Mr.B.Baggins has just computed the operating margin

Q90: EXLO Company has current sales of $100,000

Q91: Discuss three issues that make the comparison

Q92: Identify three potential users of financial ratios,and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents