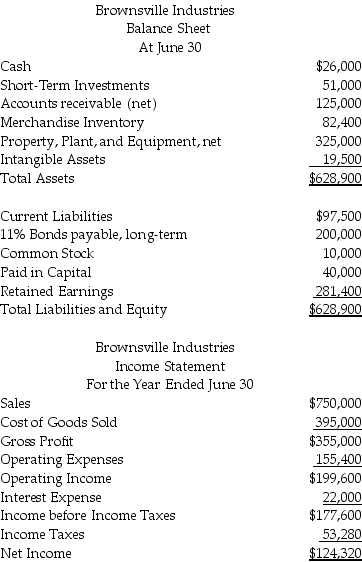

Presented below are financial statements for Brownsville Industries:

Compute the following ratios

Compute the following ratios

a.Current ratio

b.Debt to Equity Ratio

c.Interest Coverage Ratio.

d.Return on Assets

e.Financial Leverage.

f.Return on Equity

What do these ratios reveal about the financial condition of Brownsville Industries?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: The formula for interest coverage ratio includes

Q145: The interest coverage ratio for Matthews Corporation

Q146: The return on equity for Teague Industries

Q147: The return on assets for Matthews Corporation

Q148: The debt to equity ratio for Matthews

Q149: The current ratio for Teague Industries is

Q151: The debt to equity ratio for Teague

Q152: The financial leverage for Teague Industries is

Q153: The return on assets for Teague Industries

Q154: Working capital for Teague Industries is _.

A)$6,250

B)$6,912

C)$1,726

D)$11,436

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents