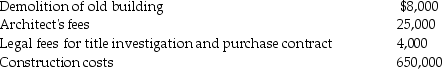

On February 1,2017,Ursa Corporation purchased a parcel of land as a factory site for $100,000.It demolished an old building on the property and began construction on a new building that was completed on October 2,2017.Costs incurred during this period are:

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

Required:

a.At what amount should Ursa record the cost of the land and the new building,respectively?

b.If management misclassified a portion of the building's cost as part of the cost of the land,what

would be the effect on the financial statements?

Correct Answer:

Verified

Land:

Building:

b.

If a porti...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: When more than one different type of

Q4: Capitalization is the process of recording an

Q7: A cost that is recorded as an

Q12: Property, plant, and equipment include both tangible

Q14: For constructed assets, the amount of capitalized

Q22: Seeder Inc.made a lump-sum purchase of three

Q23: Scrap value is also referred to as

Q24: During 2016,Dosekis Co.incurred average accumulated expenditures of

Q25: Alzparker Company constructed a building at a

Q33: All fixed assets with a useful life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents