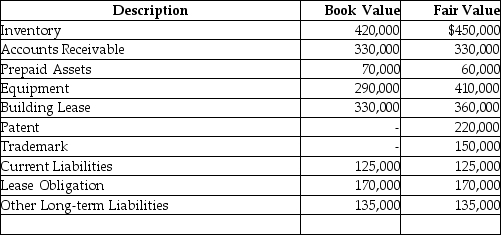

Capitol Company decided to sell one of its subsidiaries,Subsidiary ABC.BiRite Inc,is the purchaser of this subsidiary.The selling price for Subsidiary ABC is $2,000,000.BiRite performed a valuation analysis of Subsidiary's ABC assets acquired and liabilities.The following table presents book values from Subsidiary ABC financial statements and fair values determined by BiRite:

a.Prepare the journal entry made by BiRite to record the acquisition of Subsidiary ABC.

a.Prepare the journal entry made by BiRite to record the acquisition of Subsidiary ABC.

b.Describe how the journal entry would be different if the acquisition prices was $1 million.

Correct Answer:

Verified

b.

If the acquisition price was ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Under current accounting practice, what are the

Q113: List and briefly describe five types of

Q118: The capitalizable value of goodwill is always

Q119: Which of the following costs should be

Q121: Candalibra Company incurred the following costs during

Q127: U.S. GAAP requires straight-line amortization of finite-life

Q128: Companies should evaluate indefinite life intangible assets

Q136: Finite-life intangible assets are reported on the

Q139: Factors considered in determining an intangible asset's

Q140: Rinky-Dink Inc.incurred research and development costs of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents