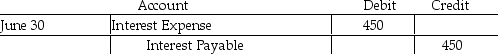

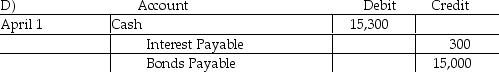

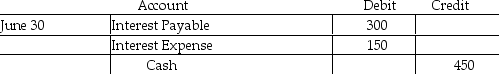

Samuel's,Inc.sold $15,000 of 6% bonds to an individual on April 1 at par value.The bonds pay interest on June 30 and December 31 each year.What are the proper entries for the sale of the bonds and the June 30 payment of the interest for these bonds?

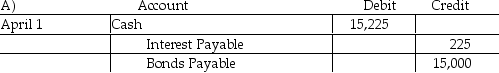

Correct Answer:

Verified

Q63: Wilson Corp.issued $1,000,000 of 4% bonds on

Q67: Jorge Corp issued $500,000 of 6%,5-year bonds

Q67: When bonds are sold between interest dates,

Q69: Clausen Corp.,an IFRS company,sold $1,000,000 of 6%,3-year

Q70: A company's calculated effective borrowing rate is

Q72: When bonds are sold between interest dates,

Q73: Walker,Inc.issued $600,000 of 5%,5-year bonds dated January

Q76: Hudson, Inc. issued $500,000 of 5%, 5-year

Q77: All companies capitalize bond issue costs which

Q79: When working with bonds issued between interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents