Mozart & Company issued 1,500 shares of 5%,$50 par value,preferred stock for $150,000.The board of directors declared dividends on December 30,to be paid in January.What journal entry is necessary to record the declaration of dividends?

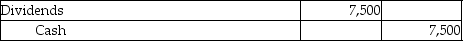

A)

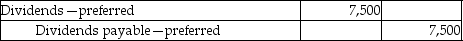

B)

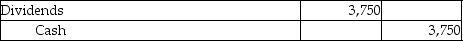

C)

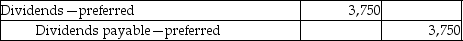

D)

Correct Answer:

Verified

Q63: On January 1,2013,Moulin Company issued 1,200 shares

Q64: Small stock dividends are valued at the

Q65: _ are shares for which the issuing

Q66: On January 1,2014,TNT,Inc.issued 1,500 shares of $50

Q67: Bach,Inc.issued 800 shares of 8%,$80 par value,preferred

Q71: On January 1,2014,Illusions,Inc.issued 800 shares of $80

Q72: Under U.S. GAAP, _ preferred shares are

Q73: On January 1,2013,Warhol Company issued 1,000 shares

Q76: Convertible preferred shares are often accounted for

Q83: Retained earnings are amounts invested by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents