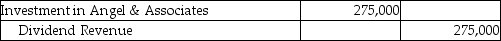

Cider Jewelers purchased 3,000,000 of the outstanding 10,000,000 shares of Angel & Associates.Cider has significant influence over Angel,so Cider will account for this investment using the equity method.Angel declared dividends of $275,000 during the year.Which of the following is the correct journal entry for this transaction?

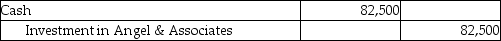

A)

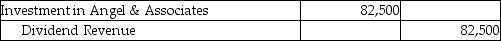

B)

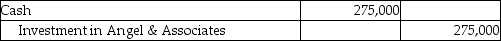

C)

D)

Correct Answer:

Verified

Q106: If the stated interest rate of a

Q108: Eagle Exporters purchased 40,000 of the 100,000

Q109: The face value and present value of

Q110: If note receivable payment dates do not

Q111: On January 1,Austin Corporation purchased 30% of

Q112: Refer to Sheppard Corporation.Assume that Sheppard purchased

Q113: When a note's stated interest rate is

Q114: Refer to Sheppard Corporation.Assume that Sheppard purchased

Q115: Crush Enterprises purchased 500,000 of the 1,000,000

Q117: Jardon Jewelers purchased 3,000,000 of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents