Meyer Jewelers purchased 3,000,000 of the outstanding 10,000,000 shares of Angel & Associates.Meyer has significant influence over Angel,so Meyer will account for this investment using the equity method.On the purchase date,Angel had net assets with a book value of $7,300,000 and a fair value of $8,000,000.The difference in fair value is a result of the higher fair value of equipment than it's book value.The remaining useful life of this equipment is 25 years.Assuming this investment was purchased on 1/1,which of the following is the correct journal entry to record the difference in net assets for this investment on 12/31?

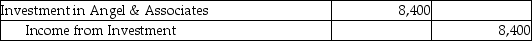

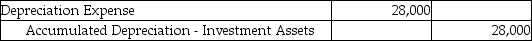

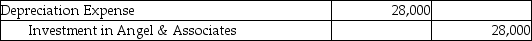

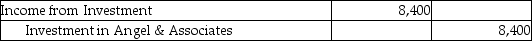

A)

B)

C)

D)

Correct Answer:

Verified

Q87: Under the equity method of accounting for

Q100: If an investee's net assets are not

Q101: Refer to Sheppard Company.What will be the

Q102: Crush Enterprises purchased 500,000 of the 1,000,000

Q103: Keller Jewelers purchased 3,000,000 of the outstanding

Q106: Zeng Jewelers purchased 3,000,000 of the outstanding

Q107: Refer to Sheppard Company.What will be the

Q108: Eagle Exporters purchased 40,000 of the 100,000

Q113: When a note's stated interest rate is

Q118: A Discount on Notes Receivable results from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents