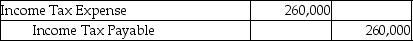

Brown Inc.'s net income after taxes is $260,000 and its tax rate is 35%.Assuming no book-tax income difference,what is the journal entry to record income tax expense?

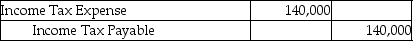

A)

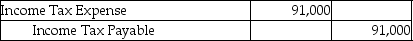

B)

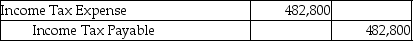

C)

D)

Correct Answer:

Verified

Q5: The effective tax rate is the legally

Q10: Which of the following statements best describes

Q13: Dante Inc. reported fines and penalties on

Q16: U.S. GAAP requires companies to reconcile the

Q17: TNT Corporation's income tax payable is $210,000

Q20: Charmed Inc.'s income before taxes is $710,000

Q21: Betz Corporation's income before taxes is $725,000

Q23: Refer to Kravitz Corporation.What is Kravitz' effective

Q24: Piper Inc.'s income before taxes is $550,000

Q60: When a company depreciates a fixed asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents