Piper,Inc.reported a net deferred tax asset balance of $190,000 resulting from an estimated warranty expense accrual for book purposes.The total book-tax difference related to the bases of the estimated warranty liability is $475,000.The enacted statutory tax rate related to this balance changed from 40% to 35%,effective immediately.What journal entry will Piper need to make to adjust for this change in tax rates?

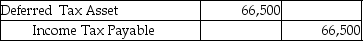

A)

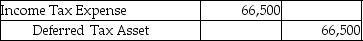

B)

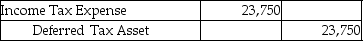

C)

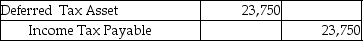

D)

Correct Answer:

Verified

Q68: S & C Company's net income before

Q70: Lyon Ltd.,a U.S.GAAP reporter,provides the following information:

Sales

Q72: Blue Corporation is an IFRS reporter.Blue's income

Q75: Tommy Corp.reported a net deferred tax asset

Q76: In 2015 Charmed,Inc.recorded book income of $370,000.The

Q77: Clunker Car Corporation reported a $3 million

Q91: When a company adjusts the balance of

Q114: When a company carries forward a net

Q116: In which of the following instances would

Q118: If a company chooses to carryback a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents