Betta Group just completed its second year of operations and has a deferred tax asset of $75,200 related to a net operating loss of $235,000 from the previous year.In the current year Betta generates $645,000 in revenues and incurs $321,000 in expenses.There are no permanent or temporary book-tax differences.Assuming the same tax rate as last year,what is the tax related journal entry for the current year?

A)

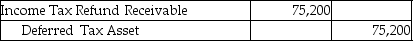

B)

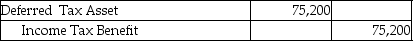

C)

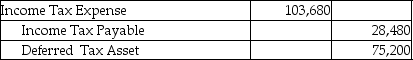

D)

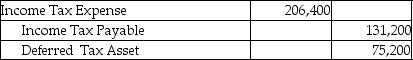

Correct Answer:

Verified

Q79: The Betta Group reports income before taxes

Q83: TLR Productions reported income before taxes of

Q85: In 2015 Tetra Corp.generated $583,000 in revenues

Q86: List the four possible sources of taxable

Q86: Illusions Inc.just completed its second year of

Q87: Red Lantern Company experienced a net operating

Q88: In 2015,its first year of operations,Neuro Inc.experienced

Q89: Caesar Corporation reported income before taxes of

Q106: A company may carry back a tax

Q122: Accounting for uncertain tax positions under IFRS

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents