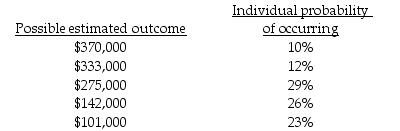

Kramerica Corporation took an aggressive tax position in its current year's tax return,claiming a $370,000 deduction.The company reported $770,000 in taxable income before considering the tax deduction,and is subject to a 33% income tax rate.Tax authorities have challenged this type of tax deduction in the past and Kramerica is now concerned about the realizability of this tax deduction in the future.However,management believes that it is more likely than not that the firm will sustain the tax benefits upon examination by tax authorities.The company provides the following analysis regarding the probabilities of sustaining the tax deduction:

Prepare the journal entry to record the current year's tax provision and the liability for the uncertain tax provision.

Prepare the journal entry to record the current year's tax provision and the liability for the uncertain tax provision.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Tetra Corp,an IFRS reporter,has the deferred tax

Q108: Under U.S.GAAP companies classify individual deferred tax

Q109: Income tax rate reconciliation under IFRS begins

Q110: Ivy Group reported income from continuing operations

Q111: In 2015,the MoosePants Corporation reported income from

Q117: Refer to Sonic Speaker Company.What is the

Q123: Under GAAP, the balance sheet presentation for

Q127: Under IFRS, the balance sheet presentation for

Q131: A firm is not required to reconcile

Q145: Companies are required to disclose the amount

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents