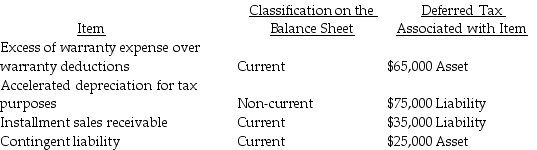

Crystal Critters,Inc.,a U.S.GAAP reporter,has the deferred tax assets and liabilities presented below:  Assuming it meets the conditions to net assets and liabilities,what amount will the company report for the net current and non-current deferred taxes?

Assuming it meets the conditions to net assets and liabilities,what amount will the company report for the net current and non-current deferred taxes?

A) net current deferred tax liability $55,000; non-current deferred tax liability $75,000

B) net current deferred tax asset $55,000; non-current deferred tax liability $75,000

C) net current deferred tax asset $90,000; net non-current deferred tax liability 110,000

D) net current deferred tax liability $35,000; net non-current deferred tax asset $75,000

Correct Answer:

Verified

Q100: In 2015,its first year of operations,Moulin &

Q102: Woods Company reports income before taxes in

Q103: Refer to Sonic Speaker Company.What is the

Q107: Tetra Corp,an IFRS reporter,has the deferred tax

Q108: Under U.S.GAAP companies classify individual deferred tax

Q109: Income tax rate reconciliation under IFRS begins

Q110: Ivy Group reported income from continuing operations

Q124: Netting deferred tax assets and liabilities is

Q126: Identify and explain the steps in U.S.

Q146: Moose Company has a high conservatism ratio.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents