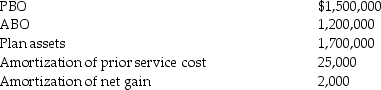

Pension data for John Ferguson Company include the following for the current calendar year:

Discount rate: 7%

Expected return on plan assets: 11%

Actual return on plan assets: 10%

Service cost: $250,000

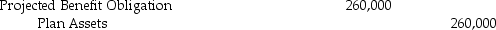

January 1:

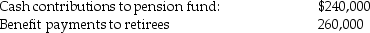

December 31:

December 31:

Required:

Required:

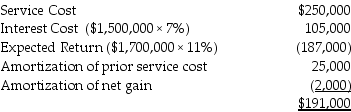

1.Determine pension expense for the year.

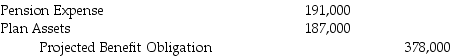

2.Prepare the journal entries to record pension expense and funding and distributions to employees for the year.

2.Prepare the journal entries to record pension expense and funding and distributions to employees for the year.

Correct Answer:

Verified

Q90: At the beginning of the current year,Miller

Q92: At December 31,Year 1,Musslewhite Corporation reported a

Q93: Amortizing a net gain for pensions will

Q94: Explain the differences between accounting for defined

Q96: Nonpublic entities are not required to separately

Q98: Which of the following is not a

Q99: How is interest cost calculated for a

Q115: If a pension plan is underfunded, it

Q123: When pension plan assets exceed pension plan

Q134: An underfunded pension plan increases a company's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents