Anzelmo Corporation invested in Jones Manufacturing by purchasing a 10% interest in the company.Anzelmo had no significant influence in Jones.Over time,Anzelmo acquired more shares in Jones,and in 2016,Anzelmo's president became a member of the board of directors when its ownership interest reached 30% of Jones.The cost basis of their investment is $2,000,000.Under the equity method,the valuation of the investment would be $2,400,000.The fair value of the investment is $2,600,000.What is the proper journal entry to properly record the change in accounting principal,ignoring income taxes?

A) No entry needed.

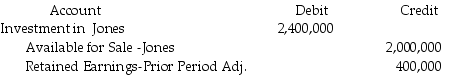

B)

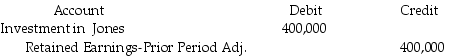

C)

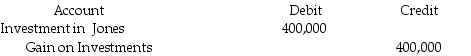

D)

Correct Answer:

Verified

Q21: Fields Construction decides to change from completed-contract

Q22: Johnston Controls began operation in 2014 using

Q23: Journal entry for the year of the

Q25: Anzelmo Corporation invested in Jones Manufacturing by

Q28: Hampton's Construction,Inc.decided to change from completed-contract method

Q29: When a company makes a change in

Q29: Butler Products decided in 2016 to change

Q30: Bronco Construction,Inc.decided to change from completed-contract method

Q31: Energy,Inc began operations in 2015 using LIFO

Q36: Which one of the following would not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents