The IRS is investigating Miller Productions tax returns for 2015 and 2016.Based on the IRS audit procedures,the company accrued a $50,000 loss additional assessment in 2016 for the 2015 tax year.At the end of 2016,Miller was able to settle with IRS for $62,000.What entry should Edwards make when it pays the deficiency in December,2016?

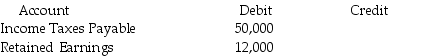

A)

Cash 62,000

Cash 62,000

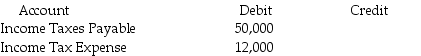

B)

Cash 62,000

Cash 62,000

C)

Cash 38,000

Cash 38,000

D)

Cash 62,000

Cash 62,000

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: When accountants discover material errors, they must

Q72: Presenting consolidated statements instead of individual financial

Q73: Humphrey Contractors purchased customized equipment in January,2015

Q74: Peoples Corporation purchased a building on December

Q75: Miller Manufacturing purchased a packaging machine for

Q76: John Pickens writes mystery novels.His publisher pays

Q79: Changes in reporting entities are handled prospectively.

Q80: Highland Corporation has always used declining-balance depreciation

Q82: When a self-correcting error is discovered after

Q83: Describe a change in reporting and discuss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents