JAT Corp.loaned $375,000 for three years to a major supplier on July 1,2015.The note stipulated 10% interest to be paid annually each June 30.Since this was an unusual transaction,no one billed the supplier for the interest in 2016 or recorded the accrued interest at the year end (December) .On March 1,2017,after the 2016 books were closed,the CFO found the error.Which one of the following is the correct journal entry to correct the errors thru March 1,2017? (Ignore income taxes.)

A) Since it has not been billed,no entry should be made until June 30,2017.

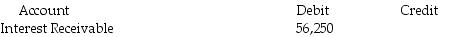

B)  Retained Earnings-Prior Period Adjustment 56,250

Retained Earnings-Prior Period Adjustment 56,250

C)  Interest Revenue 6,250

Interest Revenue 6,250

Retained Earnings-Prior Period Adjustment 56,250

D)  Interest Revenue 56,250

Interest Revenue 56,250

Correct Answer:

Verified

Q67: A change in reporting entity must be

Q94: If a firm discovers a self-correcting error

Q102: Austin Motor Works declared a 5% stock

Q103: At the end of 2015,the payroll supervisor

Q104: During 2015,a $50,000 loss on the sale

Q106: A material error in ending inventory requires

Q107: In 2015,Antiques,Inc.incorrectly recorded ending inventory as $970,000

Q108: Braun Corp.purchased a service vehicle liability policy

Q109: In completing the adjusting entries for 2017

Q110: Vieta,Inc.'s CFO discovered a program error in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents