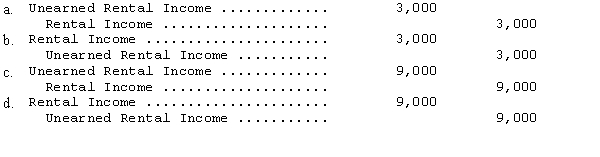

L.Lane received $12,000 from a tenant on December 1 for four months' rent of an office.This rent was for December,January,February,and March.If Lane debited Cash and credited Unearned Rental Income for $12,000 on December 1,what necessary adjustment would be made on December 31?

Correct Answer:

Verified

Q41: Under the cash basis of accounting,

A) revenues

Q45: Total net income over the life of

Q48: Comet Corporation's liability account balances at June

Q50: Kite Company paid $24,900 in insurance premiums

Q51: Chips-n-Bits Company sells service contracts for personal

Q53: Ingle Company paid $12,960 for a four-year

Q53: Sky Company collected $12,350 in interest during

Q57: The use of computers in processing accounting

Q59: The following balances have been excerpted from

Q60: The following balances have been excerpted from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents