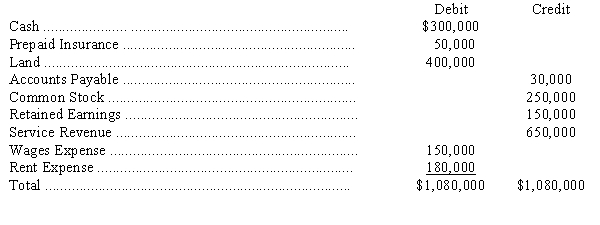

The following account balances pertain to the Henryville Manufacturing Co.at December 31,2013 (before adjusting entries).

Additional information:

(a)Prepaid insurance in the trial balance represents an advance payment for 5 months of insurance made on November 1,2013.

(b)In July,the accountant debited accounts payable for a $10,000 fine for a pollution violation; "Environmental Expense" should have been debited.

(c)Rent expense in the trial balance represents an advance payment for 6 months rent paid on October 1,2013.The Company begins occupying the property on that date.

(d)Unpaid and unrecorded wages earned by employees at December 31,2013,were

$60,000.

(e)The income tax liability for the year is $100,000,payable April 15,2014.

Required:

(1)Prepare adjusting entries to Henryville Co.'s accounts at December 31,2013.Each entry should be made in general journal format.Identify each entry by using the letter of the paragraph containing the additional information for the entry.

(2)Prepare the current year income statement

.

(3)Prepare the current year retained earnings statement.

(4)Prepare the current year balance sheet.

(5)Prepare the closing entries.

Correct Answer:

Verified

Q78: On August 1,a company received cash of

Q81: For each of the journal entries below,write

Q81: Ryan Company purchased a machine on July

Q82: The trial balance and transaction descriptions below

Q83: Account balances taken from the ledger of

Q86: Statement of Financial Accounting Concepts No.1 states

Q87: The information listed below was obtained from

Q88: Carbon Company's accounting records provided the following

Q97: Carlton Company sold equipment for $3,700 that

Q98: Pheasant Tail Company's total equity increased by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents