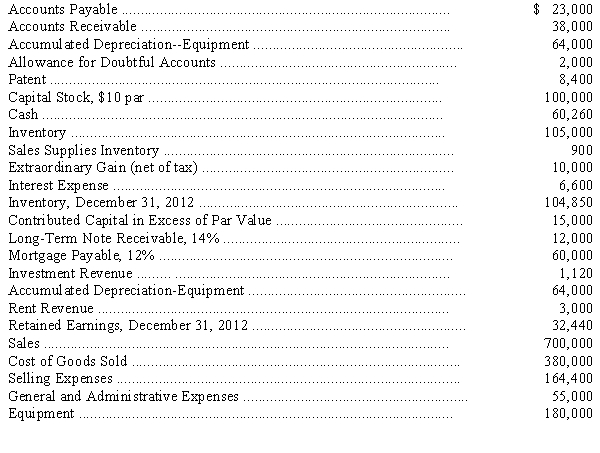

Account balances taken from the ledger of Owens Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)Estimated bad debt loss rate is 1/4 percent of credit sales.Credit sales for the year amounted to $200,000.Classify bad debt expense as a selling expense.

(b)Interest on the long-term note receivable was last collected August 31,2013.

(c)Estimated life of the equipment is 10 years,with a residual value of $20,000.Allocate 10 percent of depreciation expense to general and administrative expense and the remainder to selling expenses.Use straight-line depreciation.

(d)Estimated economic life of the patent is 14 years (from January 1,2013)with no residual value.Straight-line amortization is used.Depreciation expense is classified as selling expense.

(e)Interest on the mortgage payable was last paid on November 30,2013.

(f)On June 1,2013,the company rented some office space to a tenant for one year and collected $3,000 rent in advance for the year; the entire amount was credited to rent revenue on this date.

(g)On December 31,2013,the company received a statement for calendar year 2013 property taxes amounting to $1,300.The payment is due February 15,2014.Assume that the payment will be made on February 15,2014,and classify expense as selling expense.

(h)Sales supplies on hand at December 31,2013,amounted to $300; classify as selling expense.

(i)Assume an average income tax rate of 40 percent corporate tax rate on all items including the extraordinary gain..

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Correct Answer:

Verified

Q72: On August 1 of the current year,Kyle

Q81: Ryan Company purchased a machine on July

Q92: The records of McGarrett Corp.show the following

Q93: Schroeder Co.had the following transactions pertaining to

Q95: The records of Majestic Co.showed the following

Q96: The following ten items are independent of

Q97: Record the following transactions and events of

Q98: Pheasant Tail Company's total equity increased by

Q98: Presented below is the December 31 trial

Q99: The following data are from a comparison

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents