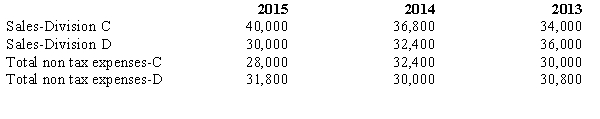

Amityville Company has two divisions,C and D.The operations and cash flows of these two divisions are clearly distinguishable.On July 1,2015,the company decided to dispose of the assets and liabilities of Division D.It is probable that the disposal will be completed early next year.The revenues and expenses of Amityville Company for 2015 and for the preceding two years are as follows:

During the latter part of 2015,Amityville disposed of a portion of Division D and recognized a pretax loss of $10,000 on the disposal.The income tax rate for Amityville Company is 40%.

Prepare the comparative income statements for Amityville Company for the years 2013,2014,and 2015.

Correct Answer:

Verified

Q56: Harris Company reported the following results from

Q57: Funnies-R-Us,Inc.committed to sell its comic book division

Q58: The financial statements of Bollinger Corporation for

Q59: Zeus and Company's income statement for the

Q60: The changes in account balances of the

Q61: The revenue principle states that revenue should

Q64: The forecast of income for future periods

Q65: A classic definition of income states that

Q66: The following pretax amounts pertain to the

Q71: International Accounting Standard 8 requires

A) a restatement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents