The following information is available for Ohio & West Virginia,Inc,from the company's annual Form 10-K:

"Ohio & West Virginia,Inc.(OWV)is a world-class provider of rail-freight transportation and its supporting services.OWV functions as a holding company with subsidiaries that own and operate regional freight railroads.We own or have interests in 47 railroads in five countries (United States,Canada,Mexico,Bolivia and Australia),and operate over 9,300 miles of owned and leased track and more than 3,000 additional miles under track-access arrangements.

Our revenues are generated primarily from the movement of freight over track owned or operated by our railroads.At the heart of OWV's success is the integration of our railroads into strong regional rail systems.Our subsidiary,LinkRail,Inc.,provides freight car switching and rail-related services to industrial companies operating extensive railroad facilities within their own complexes".

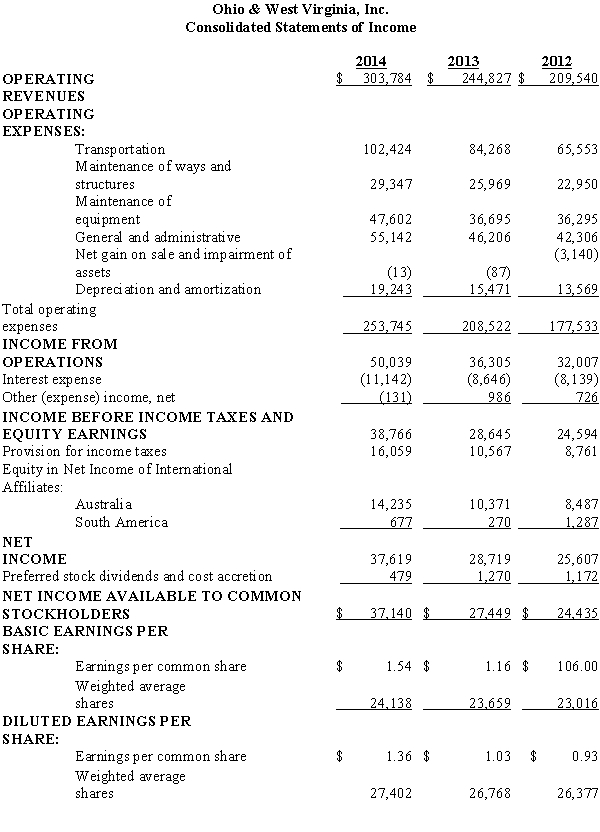

Information from the company's income statement contained in the Form 10-K annual report to the Securities and Exchange Commission is as follows:

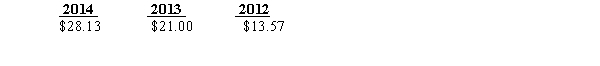

CLOSING STOCK PRICES AT DECEMBER 31:

Required:

Answer the following questions:

1.What was the percentage increase in sales from 2012 to 2013,and from 2013 to 2014?

2.What was the price/earnings ratio for each year?

3.A frequently used measure of performance in the railroad industry is the operating ratio,i.e.,total operating expenses divided by total operating revenues.What were the operating ratios for 2012,2013,2014?

4.What additional information would be useful in analyzing this income statement?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Which of the following is true regarding

Q64: Which of the following accounting changes requires

Q76: The following data are available for Synopsis

Q78: The following data are available from the

Q80: Panther Corp.reported the following pretax amounts for

Q81: Mayordomo,Inc.,has several operating divisions.In September 2014,the management

Q82: Sovereign Enterprises,Inc.,has two operating divisions,one manufactures machinery

Q84: Indicate which of the items below should

Q85: Ladrillo Enterprises,Inc.,has two operating divisions,one manufactures farm

Q86: A significant part of the compensation received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents