A review of the financial records of Stonehenge,Inc.for the current year revealed the following information:

(a)Reported interest expense of $36,000.The Interest Payable balance decreased $4,000.

(b)Declared and paid cash dividends of $175,000.

(c)Purchased a $400,000 building with a $220,000 long-term mortgage note.The remainder was paid in cash.

(d)Issued bonds with a $600,000 par value to retire 6,000 shares of $100 par value preferred stock.

(e)Held-to-maturity securities with a book value of $7,600 were sold for $9,000 during the year.

(f)Reported income tax expense of $55,000.The Income Taxes Payable balance increased $15,000.

(g)The Accounts Payable balance increased $7,740.

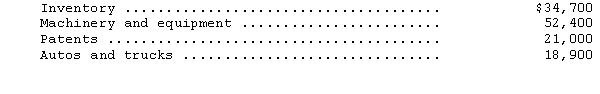

(h)Cash of $127,000 was paid to purchase business assets consisting of:

(i)Sold equipment with a net book value of $95,000 for $99,700.

(j)Issued $75,000 in common stock to acquire land with a selling price of $120,000.The difference was paid in cash.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Correct Answer:

Verified

Q67: Robinson Company reported a net loss of

Q69: Sapphire Company reported the following information for

Q72: The Dakota Corporation prepared,for 2014 and 2013,the

Q73: The following pertains to the Excelsior Corp.for

Q74: Partial balance sheet data and additional information

Q76: The following is a comparative balance sheet

Q78: The following data were taken from the

Q80: Patterson,Inc.,has the following comparative balance sheets and

Q81: The following information is provided by Horizons

Q82: The following is a partial balance sheet

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents