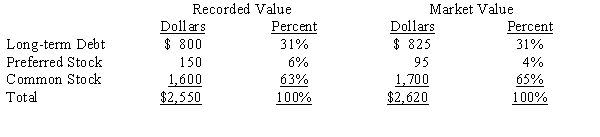

The following summarized information is available for Eastern Valley Company at December 31 of the current year:

The debt of Eastern Valley has a before-tax cost rate of 11.5%,preferred stock has a cost of 12.1%,and common equity has a cost of 14.2%.The tax rate for Eastern Valley is 34%.

Calculate the weighted average cost of capital for Eastern Valley at December 31 of the current year.

Correct Answer:

Verified

Q24: Recognizing more bad debt expense in a

Q25: Which of the following is true about

Q30: Which of the following is true regarding

Q34: Internal earnings targets represent an important tool

Q35: Trashbin is a waste disposal company.Explain the

Q40: You are auditing a company whose management

Q41: Managers of many companies frequently provide a

Q42: The existence of earnings management techniques does

Q43: Earnings management can range from methods that

Q44: Statement of Financial Accounting Concepts No.1,"Objectives of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents