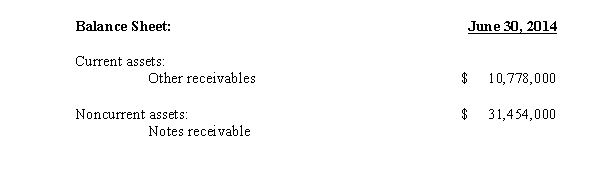

The annual report of McGregor Manufacturing showed the following in the 2014 balance sheet:

Footnote information:

The fair value of the notes receivable was estimated by discounting the future cash flows using current rates available to similar borrowers under similar circumstances.

All notes receivable bear interest at 5% to 12% and require future principal payments of approximately $547,000 in 2015,$3,742,000 in 2016,$1,015,000 in 2017,$683,000 in 2018,$661,000 in 2019,and $25,353,000 thereafter.The current portion of these long-term notes is included in other receivables in the consolidated balance sheets.

Required:

1.Estimate the average term of the notes and the interest rates at which these notes were issued by customers of McGregor.

2.Why would the interest rates vary so much?

3.Are the stated rate and the prevailing market rate of interest similar or quite different at the date of issue?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Foreman Company sells specialized machinery and equipment.On

Q62: Eastern Company sells products covered by a

Q77: The following information was abstracted from the

Q78: Halen Company factored $50,000 of its accounts

Q79: The books of Barry's Service,Inc.disclosed a cash

Q81: On January 1,2014,Nonsuch Corporation sold specialized equipment

Q82: See Foreman Company information above.

Required:

Explain how and

Q84: Cash,the most liquid of all assets,must be

Q86: The following is information from the books

Q87: Securitization is a widely-used arrangement for selling

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents