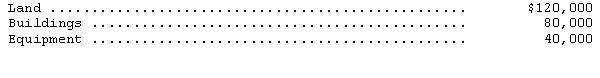

The Morris Corporation acquired land,buildings,and equipment from a bankrupt company at a lump-sum price of $180,000.At the time of acquisition,Morris paid $12,000 to have the assets appraised.The appraisal disclosed the following values:

What cost should be assigned to the land,buildings,and equipment,respectively?

A) $64,000, $64,000, and $64,000

B) $90,000, $60,000, and $30,000

C) $96,000, $64,000, and $32,000

D) $120,000, $80,000, and $40,000

Correct Answer:

Verified

Q25: Which of the following concepts is often

Q28: Which of the following is true?

A) The

Q30: Bluesy Company purchased land with a current

Q34: The third year of a construction project

Q34: Song Company started construction on a building

Q38: The general ledger of the Flybird Corporation

Q44: Which of the following most accurately describes

Q47: A copyright is an example of which

Q52: A trademark is an example of which

Q60: Acquired in-process research and development should be

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents