Osborne Company acquired three machines for $200,000 in a package deal.The three assets together had a book value of $160,000 on the seller's books.An appraisal costing the purchaser $2,000 indicated that the three machines had the following market values (book values are given in parentheses):

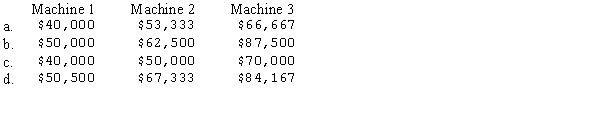

Machine 1: $60,000 ($40,000)Machine 2: $80,000 ($50,000)Machine 3: $100,000 ($70,000)The three assets should be individually recorded at a cost of (rounded to the nearest dollar)

Correct Answer:

Verified

Q21: Place Company started construction of a new

Q22: A machine with an original estimated useful

Q25: An expenditure subsequent to acquisition of assembly-line

Q26: On June 30,2014,Diode Inc.purchased for cash at

Q28: On February 12,Oceans Company purchased a tract

Q31: Broham Manufacturing Company purchased a machine on

Q33: Sonora Company borrowed $400,000 on a 10

Q36: Bluesy Company acquired land and paid for

Q37: On October 1,Azuma,Inc.exchanged 8,000 shares of its

Q39: Diamond,Inc.purchased a machine under a deferred payment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents