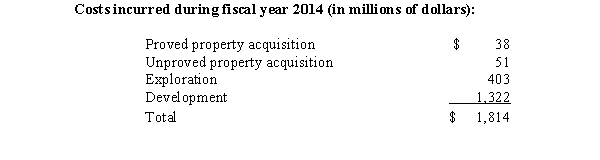

The 2014 annual report of Fracking,Inc.,provides the following disclosures regarding its oil and gas operations:

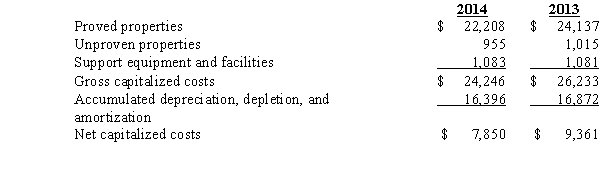

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were:

Capitalized costs for fiscal years ending December 31,2014,and 2013 (in millions dollars):

Fracking uses the successful-efforts method to account for exploration costs.

Required:

1.What amount of the exploration cost incurred by Fracking in 2014 were capitalized?

2.If Fracking were using the full-cost method of accounting for exploration cost,what amount of exploration cost would be capitalized in 2014.State any assumptions made in order to answer this question.

3.Use the information above to determine the amount of capitalized costs removed (retired or otherwise disposed of)from the capitalized cost account,and the amount of accumulated depreciation,depletion,and amortization related to this item.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Which of the following assets generally is

Q75: The impairment test for an intangible asset

Q76: The following is a schedule of machinery

Q77: A recently issued FASB standard requires that

Q77: Information concerning Santori Corporation's intangible assets is

Q78: Algon Company owns a machine that cost

Q80: Python Mining Company has a copper mine

Q81: Image Creators,Inc.owns the following equipment and computes

Q83: Wastenot is a waste disposal company.Explain the

Q84: Roadworthy Company acquired Highway Company on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents