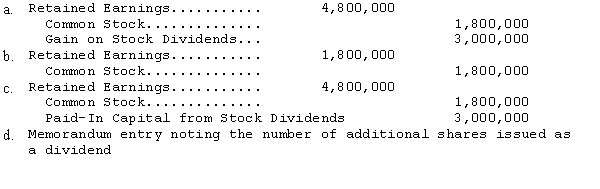

Island Company has 1,000,000 shares of common stock authorized with a par value of $3 per share of which 600,000 shares are outstanding.Island authorized a stock dividend when the market value was $8 per share,entitling its stockholders to one additional share for each share held.The par value of the stock was not changed.Assuming the declaration is not recorded separately,what entry,if any,should Island make to record distribution of the stock dividend?

Correct Answer:

Verified

Q65: Adam Corporation owns 1,000 shares of common

Q72: The Mailer Corporation had the following classes

Q73: The following data are extracted from the

Q74: On December 31,2014,the stockholders' equity section of

Q75: Lexan Company reported the following for the

Q78: On January 2,2014 the board of directors

Q80: On June 30,2014,Lynch Co.declared and issued a

Q80: The data below are from the December

Q81: A major conclusion of the FASB's standard

Q82: The following information pertains to Hermosa Corp.for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents