In 2014,Quito Inc.purchased stock as follows:

(a)Acquired 2,000 shares of Hollow Arts Corp.common stock (par value $20)in exchange for 1,200 shares of Quito Inc.preferred stock (par value $30).The preferred stock had a market value of $75 per share on the date of the exchange.

(b)Purchased 800 shares of Marion Corp.common stock (par value $10)at $70 per share,plus a brokerage fee of $800.

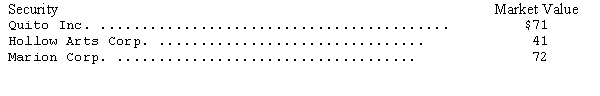

At December 31,2014,the market values of the securities were as follows:

The investments in common stock are classified by Quito Inc.as available-for-sale securities accounted for by the cost method.The fiscal year of Quito ends on December 31.

(1)Prepare all entries relating to the investments in common stock for 2014.

(2)Prepare the entry to record the sale of 200 shares of Marion Corp.common stock on January 15,2015,at $74 per share.

(3)Prepare the entry to reclassify the remaining 600 shares of Marion Corp.common stock from available-for-sale securities to trading securities on January 31,2015.The stock was selling at $67 per share on that date.

Correct Answer:

Verified

Q44: In January of 2014,Bonnie Corporation acquired 20%

Q46: On October 1,Ryan Company purchased $200,000 face

Q48: Ignoring income taxes,choose the correct response below

Q53: The market rate of interest for a

Q61: Springer Inc.carries the following marketable equity securities

Q63: The following information is available for an

Q64: The following transactions of the Macheski Company

Q65: On January 1,2014,Palsoe Corp.acquired 30 percent (13,000

Q77: On January 1,2013,a company purchased four 5%,$1,000

Q78: Cronie Enterprises purchased 10,000 shares of stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents