The inception of a lease is January 1,2014.A third party guarantees the residual value of the asset under the lease,estimated to be $12,000 at January 1,2019,the end of the lease term.Annual lease payments are $10,000 due each December 31,beginning December 31,2014.The last payment is due December 31,2018.Both the lessor and lessee use 10% as the interest rate.The remaining useful life of the asset was six years at the inception of the lease.

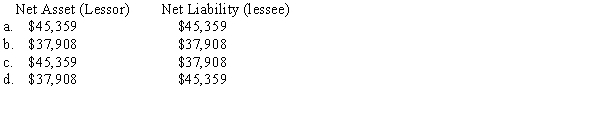

What is the net asset balance for the lessor,and net liability balance for the lessee,at the date of the inception of the lease?

Correct Answer:

Verified

Q44: Hydra Company entered into a direct-financing lease

Q48: In a lease that is recorded as

Q53: Sanborn,Inc. ,leased equipment from Chase Supply on

Q56: Patrol,Inc. ,leased a machine from Ravel Company.The

Q56: On January 1,2014,Bullitt Corporation sold a machine

Q63: Governor Corporation entered into a direct financing

Q64: Always Distributing entered into a leasing agreement

Q64: On January 2,2014,the Clapton Studios leased six

Q65: On July 1,2014,Biplane Aviation leased two company

Q72: Soundesign Company entered into a lease of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents