On January 1,2014,Logan Company leased a machine to Glasgow Company.The machine had an original cost of $60,000.The lease term was five years and the implicit interest was on the lease was 15 percent.The lease is properly classified as a direct-financing lease.The annual lease payments of $17,306 are made each December 31.The machine reverts to Logan at the end of the lease term,at which time the residual value of the machine will be $4,000.The residual value is not guaranteed.

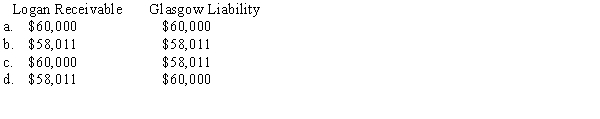

At the inception of the lease,the balance of Logan's net receivable and Glasgow's liability would be

Correct Answer:

Verified

Q68: If the lessee and the lessor use

Q69: Bayou Inc.leases equipment to its customers under

Q71: Ollie Company entered into a lease agreement

Q74: Neils Company leased an asset for use

Q75: On January 1,2014,Benjamin Industries leased equipment on

Q76: Business leasing has become a large market.Banks,other

Q78: Which of the following is true regarding

Q81: Narcissus Corporation has entered into a debt

Q82: On January 1,2014,J.M.Rodriguez,owner of JMR Sound,sold the

Q83: We-Lease-All,Inc.leased a chroming machine to Fernando's Choppers.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents