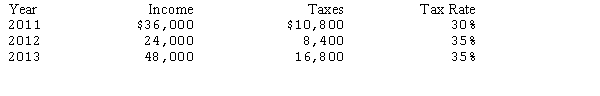

The Morris Corporation reported a $59,000 operating loss in 2014.In the preceding three years,Morris reported the following income before taxes and paid the indicated income taxes:

The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

A) $20,650

B) $22,500.

C) $21,300.

D) $20,100

Correct Answer:

Verified

Q22: In 2014,The Xavier Company,reported pretax financial income

Q26: The Racing Company had taxable income of

Q32: Historically,the United Kingdom has recognized only those

Q33: The following information was taken from Caribbean

Q34: The following information is taken from Glenville

Q34: International accounting standards currently are moving toward

Q35: Hagar Corporation reported depreciation of $250,000 on

Q36: Concourse Corporation paid $20,000 in January of

Q39: Garden Company had pretax accounting income of

Q58: For the current year,Southern Cross Company reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents