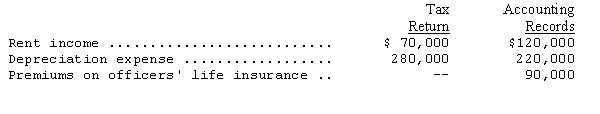

Bodner Corporation's income statement for the year ended December 31,2014,shows pretax income of $1,000,000.The following items are treated differently on the tax return and in the accounting records:

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

A) $360,000

B) $320,000

C) $294,000

D) $267,000

Correct Answer:

Verified

Q43: Which of the following does NOT help

Q46: For the current year,Phoenix Company reported income

Q52: Which of the following is an example

Q54: The books of the Speedster Company for

Q54: Which of the following is NOT a

Q56: Which of the following represents a permanent

Q58: Creative Corporation's income statement for the year

Q59: In computing the change in deferred tax

Q60: Which of the following could never be

Q61: The application of SFAS No.109 results in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents