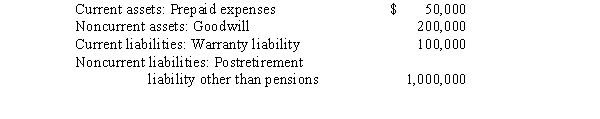

Mostel Company has each of the following items on its balance sheet at December 31,2014:

The prepaid expenses have already been deducted for tax purposes.No deductions have yet been take related to the warranty liability or the postretirement liability other than pensions.No evidence exists that the goodwill is impaired.The current and future tax rate is 35 percent.

Required:

1.Explain which of the above items requires a deferred tax amount to be recorded,the amount of each,whether each is a deferred tax asset or a deferred tax liability.

2.Determine the amounts of deferred tax asset and deferred tax liability that would be reported on the balance sheet and the current or noncurrent classification of each.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Oriole Industries computed a pretax financial income

Q76: The following differences between financial and taxable

Q77: Allsgood Appliances computed a pretax financial loss

Q78: Eva Designs,Inc.,a corporation organized on January 1,2005,reported

Q79: Seymour Associates computed a pretax financial income

Q81: SFAS No.109 uses the term "tax-planning strategy".The

Q82: The Montoya Corporation reports the following differences

Q83: Eastwood Manufacturing planned to claim a $10,000

Q84: SFAS No 109 takes a decidedly different

Q85: SFAS No.109 rejected the approach of its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents