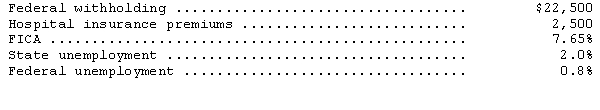

During a recent two-week period,the employees of Super Choppers,Inc.earned gross wages of $90,000.The following are the employee withholdings and payroll taxes pertinent to the period:

Only $68,000 of wages are subject to FICA,and $31,000 are subject to unemployment taxes.

(1)Prepare the entry to record the gross payroll.

(2)Prepare the entry to record employer payroll taxes.

Correct Answer:

Verified

Q64: The amount of the expected return on

Q73: Sundance Communications is considering adopting a bonus

Q75: As an incentive,Sport Enterprises awards an annual

Q76: Feinberg,Inc.,provides a noncontributory defined benefit plan for

Q77: The following balances relate to the defined

Q78: Blue Ice Inc.compensates its employees for certain

Q79: Using the information below,compute the gain or

Q80: The following information relates to the defined

Q82: Accutron Company sponsors a defined-benefit pension plan.Portions

Q83: Earthen Products,Inc.,has a noncontributory,defined-benefit pension plan.At December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents