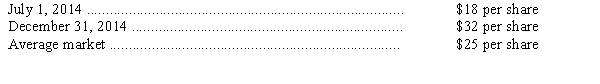

On December 31,2014,Luanne Inc.had outstanding 180,000 shares of common stock.Net income for 2014 was $285,000.Outstanding options (granted July 1,2014)to purchase 15,000 shares of common stock at $20 per share had not been exercised by December 31,2014.During 2014,market prices for Luanne's common stock were:

(1)Compute the basic earnings per common share in 2014.

(2)Compute the diluted earnings per common share in 2014.

Correct Answer:

Verified

Q61: Which combination is the correct statement regarding

Q61: The following is a partial balance sheet

Q64: Gabor Company had granted 20,000 options to

Q64: If convertible bonds are dilutive,the interest expense

Q65: At December 31,2013,DeSoto Company had 500,000 shares

Q67: On December 31,2012,Bugler Travel Inc.had 450,000 shares

Q68: At December 31,2013,Kissit Inc.had 400,000 shares of

Q69: Assume a company had net income of

Q70: The following information relates to the Tykex

Q71: Binary Controls Inc.had 250,000 shares of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents