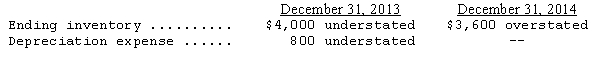

Strong Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2013 covering the years 2013,2014,and 2015.The entire amount was charged to expense in 2013.In addition,on December 31,2014,fully depreciated machinery was sold for $6,400 cash,but the sale was not recorded until 2015.There were no other errors during 2013 or 2014,and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on 2014 net income?

A) Net income is understated by $12,800.

B) Net income is overstated by $3,600.

C) Net income is understated by $1,600.

D) Net income is overstated by $2,400.

Correct Answer:

Verified

Q23: On January 1,2011,Caravanos Company purchased for $320,000

Q25: On December 31,2014,Ohio Corporation appropriately changed its

Q30: Effective January 2,2014,Moldaur Co.adopted the accounting principle

Q32: Newsman Co.made the following errors in counting

Q33: Basilia Corporation purchased a machine for $180,000

Q33: Songtress Company bought a machine on January

Q34: Cornwall Co.made the following errors in counting

Q39: McCartney Corp.reports on a calendar-year basis.Its 2013

Q41: In 2014,a company changed from the LIFO

Q55: Which of the following,if discovered by Somber

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents