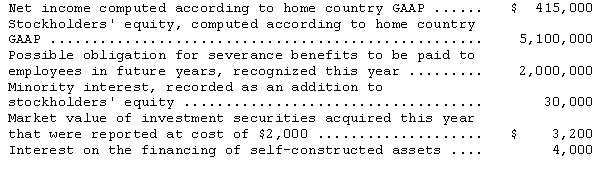

The following financial information is for Pasha Company,a non-U.S.firm with shares listed on a U.S.stock exchange:

If Pasha Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $5,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Pasha's reported stockholders' equity and net income to U.S.GAAP.

Correct Answer:

Verified

Q45: Under international accounting standards,deferred tax assets and

Q46: Which of the following statements is correct?

A)

Q47: Lunes Company,a U.S.company,owns a 100% interest in

Q49: Hibachi,Inc.,purchased Wasabi Manufacturing Company,a Japanese company,on January

Q52: Which of the following is correct regarding

Q53: Which of the following is correct regarding

Q53: McGovern Corporation,a U.S.company,owns a 100% interest in

Q55: Corrington Metalworks,Inc.,purchased Scotia Metal Products,a Scotia company,on

Q56: Which of the following statements regarding international

Q56: Under international accounting standards,remote contingent liabilities are

A)not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents