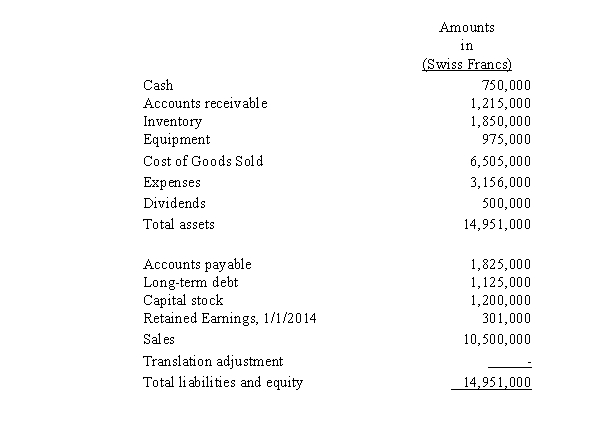

Sunrise Technological,Inc.,a U.S.multinational producer of computer hardware,has subsidiaries located throughout the world.Sunrise Technology purchased Einstein Technology Company,a Swiss producer of computer hardware components,on January 1,2013.Einstein's financial statements are prepared and submitted in Swiss francs to Sunrise's headquarters.Einstein's adjusted trial balance at December 31,2014,is presented below:

Einstein Technology Company

Adjusted Trial Balance

December 31,2014

(in Swiss Francs)

Relevant exchange rates for 2014 and 2013 are as follows:

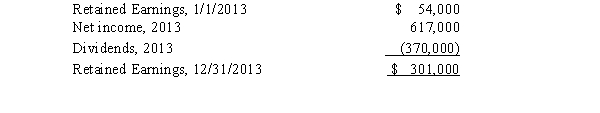

The statement of retained earnings for the year ended December 31,2013,is as follows (in U.S.dollars):

Required:

Prepare a translated statement of income and retained earnings,and a translated statement of financial position in U.S.dollars for Einstein Technology for 2014.

Correct Answer:

Verified

Translated Trial...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Under international accounting standards,the pension-related asset or

Q49: Under international accounting standards,if a sale-leaseback results

Q52: Which of the following is correct regarding

Q53: McGovern Corporation,a U.S.company,owns a 100% interest in

Q53: Which of the following is correct regarding

Q55: Corrington Metalworks,Inc.,purchased Scotia Metal Products,a Scotia company,on

Q56: Under international accounting standards,remote contingent liabilities are

A)not

Q57: The measurement of deferred tax liabilities and

Q60: The proper analysis of foreign operations by

Q62: Spirit Leatherworks,Inc.,purchased Brechner Leather Products,a Canadian company,on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents