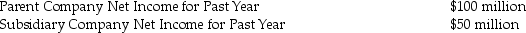

On January 1,2010,a parent company purchased 90 percent of the stock in a subsidiary.On January 1,2010,no goodwill was recorded and the book value of the subsidiary's assets equals the market value of the subsidiary's assets.On December 31,2010,the two companies report the following data:  What is the consolidated net income for the year ended December 31,2010?

What is the consolidated net income for the year ended December 31,2010?

A) $100 million

B) $135 million

C) $145 million

D) $150 million

Correct Answer:

Verified

Q41: The account "Noncontrolling Interests" as reported on

Q43: When an investing company owns less than

Q48: When a company acquires all of the

Q52: Beck Company owns a 60 percent interest

Q54: Fisher Company acquired 80 percent of the

Q59: Noncontrolling interests appear on a consolidated balance

Q60: The Investment in Subsidiary account appears on

Q60: On January 1,2015,Jane Company acquired 80 percent

Q62: On January 1,2012,a parent company acquired all

Q78: To prepare common size income statements,percentages for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents