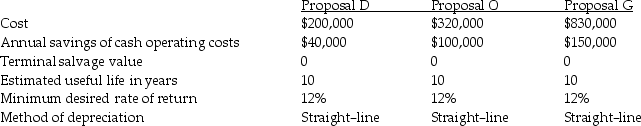

Dolly Company is contemplating three different equipment investments.The relevant data follows:

The present value factor of an ordinary annuity for 10 periods at 12% is 5.6502.

The present value factor of an ordinary annuity for 10 periods at 12% is 5.6502.

The present value factor of one for 10 periods at 12% is 0.322.

Required:

A)Compute the net present value of each investment.Ignore income taxes.

B)If only one investment can be acquired,which investment should be chosen?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: When using the NPV model,it is assumed

Q43: If a project has a positive net

Q44: If the internal rate of return on

Q46: Howell Company has the following information:

Q47: The _ cannot be used to compare

Q49: If the internal rate of return on

Q50: Mammoth Company is considering the acquisition of

Q62: Generally,the most difficult part of capital budgeting

Q65: The differential approach to investments can be

Q70: A company is considering two investment projects.If

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents