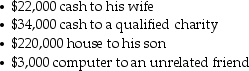

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

A) $206,000.

B) $214,000.

C) $234,000.

D) $279,000.

Correct Answer:

Verified

Q22: Charlotte pays $16,000 in tax deductible property

Q23: The unified transfer tax system

A)imposes a single

Q36: Charlie makes the following gifts in the

Q42: Denzel earns $120,000 in 2013 through his

Q45: In 2013,an estate is not taxable unless

Q51: Which of the following is not an

Q51: Eric dies in the current year and

Q58: Which of the following is not one

Q77: All of the following are classified as

Q77: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents