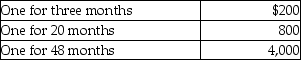

CT Computer Corporation,an accrual basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

A) $200.

B) $1,000.

C) $1,680.

D) $5,000.

Correct Answer:

Verified

Q21: Frasier and Marcella,husband and wife,file separate returns.Frasier

Q29: Todd and Hillary,husband and wife,file separate returns.Todd

Q33: Examples of income which are constructively received

Q45: Alex is a calendar-year sole proprietor.He began

Q47: One of the requirements that must be

Q53: Norah,who gives music lessons,is a calendar year

Q56: All of the following statements are true

Q77: Carla redeemed EE bonds which qualify for

Q79: Unemployment compensation is exempt from federal income

Q79: Amy's employer provides her with several fringe

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents