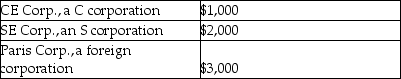

Natasha is a single taxpayer with a 28% marginal tax rate.She received dividends this year as follows:  How much of the $6,000 dividend income will be taxed at the 15% tax rate?

How much of the $6,000 dividend income will be taxed at the 15% tax rate?

A) $0

B) $1,000

C) $3,000

D) $6,000

Correct Answer:

Verified

Q65: Hoyt rented office space two years ago

Q75: In December 2013,Max,a cash basis taxpayer,rents an

Q77: Ricky has rented a house from Sarah

Q81: A taxpayer had the following income and

Q82: Under the terms of their divorce agreement

Q83: Child support is

A)deductible by both the payor

Q85: Lily had the following income and losses

Q89: With respect to alimony and property settlements

Q96: Jonathon,age 50 and in good health,withdrew $6,000

Q117: Insurance proceeds received because of the destruction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents