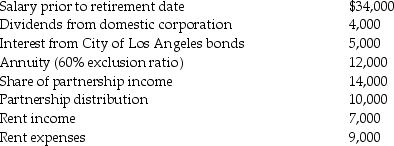

Jeannie,a single taxpayer,retired during the year,to take over the management of some rental property.She had the following items of income and expense:

What is Jeannie's adjusted gross income for the year?

What is Jeannie's adjusted gross income for the year?

Correct Answer:

Verified

Q82: Under the terms of their divorce agreement,Humphrey

Q99: Eva and Lisa each retired this year

Q100: In addition to Social Security benefits of

Q101: Marisa and Kurt divorced in 2011.Under the

Q102: As a result of a divorce,Michael pays

Q103: During 2013,Christiana's employer withheld $1,500 from her

Q104: On April 1,2013,Martha,age 67,begins receiving payments of

Q105: Gabe Corporation,an accrual-basis taxpayer that uses the

Q113: During 2013,Christiana's employer withheld $1,500 from her

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents