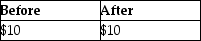

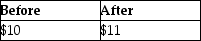

Dustin purchased 50 shares of Short Corporation for $500.During the current year,Short declared a 10% stock dividend.What is the basis per share before and after the stock dividend is distributed?

A)

B)

C)

D)

Correct Answer:

Verified

Q41: Jessica owned 200 shares of OK Corporation

Q43: Terrell and Michelle are married and living

Q44: Melody inherited 1,000 shares of Corporation Zappa

Q45: If a nontaxable stock dividend is received

Q52: In a common law state,jointly owned property

Q55: Joycelyn gave a diamond necklace to her

Q57: In a community property state,jointly owned property

Q58: Josh purchases a personal residence for $278,000

Q65: All of the following are capital assets

Q68: DeMarcus and Brianna are married and live

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents